What are Estimated Taxes?

Estimated tax is the method used to pay tax on income that is not subject to withholding. This includes income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes and awards. You also may have to pay estimated tax if the amount of income tax being withheld from your salary, pension, or other income is not enough.

Payment Schedule for Estimated Taxes

Remember to take the tax calendar into consideration while making your yearly budget. This is the following schedule for the estimated tax payments as per Federal Income Tax regulations this year.

- April 15 (first quarter)

- June 15 (second quarter)

- September 15 (third quarter)

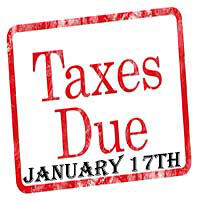

- January 15 (fourth quarter) – Jan 17th due to the weekend and holiday

The fourth quarter payment need not be paid in the tax year itself but in the beginning of the next year and before your personal and/or business tax return is due. If the date is a weekend or a holiday, it will be extended to the next business working day. (This year the due date is January 17th for 4th quarter taxes)

Compute Your Estimated Taxes & Penalties

There are some exceptions in paying estimated taxes. It may be complex to calculate the exact amount, so the IRs has Form 1040-ES with a worksheet that can be utilized to compute the tax. If at least $1000 in federal income tax is owed for a certain year, the estimated taxes are required or you can face a penalty.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

If you do not pay enough through withholding or estimated tax payments, you may be charged a penalty. If you do not pay enough by the due date of each payment period you may be charged a penalty even if you are due a refund when you file your tax return.

What If I Have Another Job with Withhold?

If you are employed and have sufficient taxes withheld from your salary, then you may not owe estimated taxes. The same applies if your spouse is employed and has sufficient taxes withheld from their salary. You can also apply your previous year refund towards your estimated taxes as well.

Resources

- More information on Estimated Taxes at IRS.gov

- Publication 505, Tax Withholding and Estimated Tax

Follow us: @the_tax_lady | TACCT on Facebook