Tax Notes

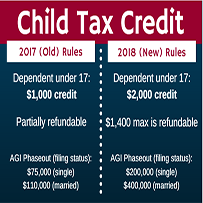

The Tax Cuts and Jobs Act raised the Child Tax Credit from $1,000 to $2,000. Of this, up to $1,400 can be a refundable credit. The Internal Revenue Service has not fully explained how this will work, but I’ll let you know as soon as they issue guidance.

What is a Qualified Education Expense?

As you send your children back to school, you may be wondering what expenses qualify for education credits or tax-free distributions from education accounts. Use the chart below as a guide. If you have any questions, give me a call. Together we can plan how to best pay for your child’s education.

Read the newsletter for more information.