Keeping your tax documents organized is a challenge, but it can not only make the tax filing season go smoothly, it can also reduce your company’s tax liability. Here are some tips to keep your business on track:

Storage

Old files must be stored away and new ones created to handle current year transactions. Think and organize with the idea that you will be audited. You will want to store files and receipts that pertain to items listed on your income tax return. So with your regular banking, vendor, and customer files include the following:

Your appointment book

The meetings and other business events listed therein will prove material participation. Also, this document supports vehicle use. List your beginning and ending odometer readings for the year in order to answer the IRS question regarding total mileage driven as well as total business miles driven.

Printouts of Financial Statements

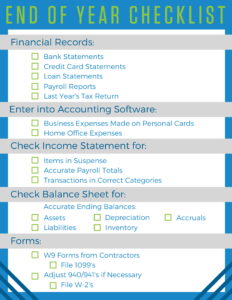

First, be sure that all accounts are reconciled and the books are ready to turn over to your tax pro for tax preparation purposes. Include a print out of the Balance Sheet and Profit and Loss as of December 31. Also print out the general ledger for the entire year, which lists the contents of every expense category that you will deduct on your tax return and is necessary to reference in the event of an audit.

Be sure that you do not store away permanent files such as asset listings, loan agreements and insurance policies. All permanent files should remain in the office within easy reach.

Balance Statement items to review:

The Balance Sheet at of the end of the year shows a quick snapshot of the business. It highlights what is owned and what is owed. This won’t factor as heavily into what gets filed on the tax return, but it’s still important for it to be accurate going into the new year. Many items on the balance sheet might need to updated or adjusted manually.

Check each ending balance. Do the account balances seem too low or high? Check into any transactions that may be inaccurate!

Assets: These are things that you own, like bank accounts, fixed asset (cars, heavy equipment) and inventory. Check the ending inventory for the year. Take an inventory count (if there is any) and make adjustments as needed. This is very important to do every year, even when using a perpetual inventory system that tracks what’s coming and going in and out of the company. Mistakes happen! Double checking with a physical inventory every year will spot these mistakes before it’s too late.

Liabilities: These are things that you owe. Look at your credit and loan balances and be sure that your statements match your accounting software.

Depreciation: This needs to be adjusted manually by creating an entry with Accumulated Depreciation and Depreciation Expense. This expense can make a huge difference on net profit which translates to how much is owed in taxes.

Payroll (and other) accruals: These are liabilities owed to employees or vendors for work done in 2018 but yet to be paid for by 2019. Adding these in keeps all 2018 expenses in 2018 where they belong, rather than in 2019 when they might be paid out.

Income Statement Items to Review:

The Income Statement (or Profit and Loss) is very important when filing taxes! Its contents essentially decide the final number on which taxes are paid, what deductions are available, and how much, if anything, the business ends up owing Uncle Sam for 2018. It’s critical to make sure that all revenue and expenses are accounted for so that Net Income or Loss is completely accurate.

Are there any items in Suspense? These are unidentified transactions that need a home! Make sure they’re all cleared out and in their correct account. Properly placing them will paint an accurate picture of the company’s financials at year end.

Are payroll totals accurate? (Huge IRS red flag). The IRS thrives on knowing how much money everyone makes, down to the penny. Review all 940/941 payments to make sure that no adjustments need to be made– or have been made, but are not yet accounted for. The numbers reported to the IRS at the end of the year when filing W-2s should match exactly what was reported on the 940/941s throughout the year. If needed, submitting an adjusted 940/941 is easy to do [much easier, it can’t be overstated, than dealing with getting it wrong!].

Are all transactions properly categorized? Even though items in suspense might be cleared out, it’s a good idea to check over all accounts and make sure there aren’t any transactions categorized incorrectly. This will ensure an accurate picture for potential deductions and help to avoid any red flags.

Were any business expenses made on personal cards? This is something that can easily slip through the cracks without being noticed. The best way to take care of these expenses is to enter them as they happen through the year while they’re fresh in mind. Things happen, and sometimes we forget. Double checking personal accounts will give peace of mind that an honest mistake won’t cause unwelcome attention. If any transactions did get missed, entering them into the accounting software for the date they appear on the personal statement will bring things to where they need to be.

Are there any home office expenses? Expenses for maintaining a home office count as business expenses! It’s even possible to portion out rent or mortgage, as well as utilities, and expense them through the business.

Estimated Tax Payments

On Jan. 15, if your business is a sole proprietorship, S Corporation, or partnership, you will likely be required to pay installment No.4 of your estimated tax payments. It must be postmarked that day for it to be considered on time. If during the year you earned wages and self-employment income in excess of $200,000 (single) or $250,000 (married filing joint), you will be subject to the 0.9% additional Medicare tax that was legislated beginning in 2013. Be sure to increase your estimated payment by this amount in order to remain in compliance. If your legal form is C corporation, check with your tax pro to determine the due date of your estimated tax payments.

Payroll

If your business subscribes to a payroll service, you are likely well taken care of as far as year-end reporting. But if you perform payroll services in house, there’s a lot of extra work in store for you or your bookkeeper.

In addition to normal quarterly filings, you are required to file Form 940 (FUTA tax) and Forms W2 by January 31 as well as any state reporting requirements. Review the W2s carefully. Reconcile the grand total of W2 wages with what is shown on your general ledger. Be sure the numbers match for each employee before mailing the W2s. Also confirm the social security numbers and mailing addresses of each employee.

Forms 1099

Also due by January 31 are Forms 1099 to recipients who provided more than $600 in services or rents. The vendor and the IRS must get a copy by this date. If you are using a software program such as QuickBooks, the program will generate the completed forms for you. You only need pick up blank forms at the office supply store. Blank forms are also available at www.irs.gov.

You can run a 1099 report to see which payees are in need of the form. Normally, a business entity that is incorporated is exempt from receiving the form. Remember though that several years ago the IRS began requiring that incorporated attorneys receive 1099 forms. Be sure that each payee has a Social Security number or federal ID number listed on the 1099 form and that the number matches the name.

In other words, if you are issuing a 1099 to Suzie Jones who owns Decked Out Deck Renovation and all you have is her social security number, make sure the first line of the address block on the 1099 form indicates Suzie Jones rather than her company name. Otherwise, you will receive a letter from the IRS stating there is a mismatch between the social security number and the recipient’s name.

Things to do at the beginning of the new year, aside from filing taxes

- Check whether any payroll rates have changed.

- Verify that your payroll reflects the most current unemployment rate and that your pay is in line with current minimum wage law.

- Work on a fresh budget using last year’s numbers. Clean things up and get on track

- Make sure the employee list is up-to-date

- Update service account passwords and who has access to them

- Update any changed policies and procedures

- Reorganize files and email inbox (groan, we know)

- Fill out a business calendar. Add in due dates for bills and taxes so that you don’t fall behind.

- Set some goals!

- What do you want to do better?

- What do you want to do more of?

- What do you want to quit doing?

Completing the above checklist will prepare you to file for 2018 and jump start your 2019 so that the end of year isn’t so scary the next time around!

Resources

- Quickbooks Online for Self-Employed

- IRS Small Business and Self-Employed Tax Center

- Publications and Forms for the Self-Employed

- Business and Taxes

Follow us: @the_tax_lady | TACCT on Facebook

Read our Tax Insight Newsletters

Schedule a Tax Appointment or Consultation